阅读:0

听报道

推文人 | 曾佳志

原文信息:Tho Nguyen, (2011) "US macroeconomic news spillover effects on Vietnamese stock market", The Journal of Risk Finance, Vol. 12 Issue: 5, pp.389-399

一、引言

文章检验了美国宏观经济新闻对越南股票市场前一两期的溢出效应。新奇的数据处理方式,灵活使用了随时间变化的 (MA-GARCH)模型是这篇文章的亮点。

一般而言,美国实体经济新闻的前一两期对越南股市收益率有着强烈的影响,这可以被解读为越南股票市场参与者认为美国的实体经济活动对股票市场的影响很大,甚至超过其他影响股票市场波动的因素。

二、数据和实证模型

1. 越南股票指数(VNI)

1998年,越南总理签发48/1998/ND-CP号法令,开放股票与证券市场,2000年7月,胡志明市的证券交易中心正式投入运营。作者收集了2008年10月-2009年9月的日收盘数据(包括股指与收益率),此处数据处理可能是对日交易指数与股指日收益率进行了加权平均,构造成月度数据,所以下文使用虚拟变量Holt和Mont做控制变量,样本量3343个。

2. 美国宏观经济新闻

收集了2000年10月-2009年9月的美国宏观经济新闻信息,主要有非农工资(NFPM)、失业率(UNEMP)、GDP变化率(GDP)、住宅统计(HOMEST)、工业产品(INDP)、领导指数(LEAD)、零售额(SALES)、消费者价格指数(CPI)、生产者指数(PPI)、经常项目(CA,季度数据)、贸易差额(BOT)、美联储目标利率(FOMC,一年发布8次)。并对宏观经济新闻数据进行标准化处理,即样本减去均值,再除以标准差。

3. Holt、Mont虚拟变量以及越南宏观经济数据(VNMacroAnni,t)

设置虚拟变量Holt和Mont作为控制变量,Holt设置标准为市场收盘日到节假日的天数,其他设置为0(数据处理用R完成);Mont设置标准为每逢周一取值为1,其他设置为0。其他越南宏观数据均为官方公开统计数据。

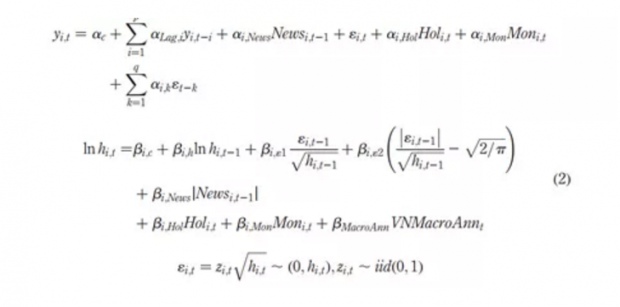

所有新闻数据序列都有较强的尖峰与非正态性,七个新闻数据序列也表现出一介序列相关,四个新闻数据序列表现出二介序列相关。设定MA-GARCH(1,1)模型如下:

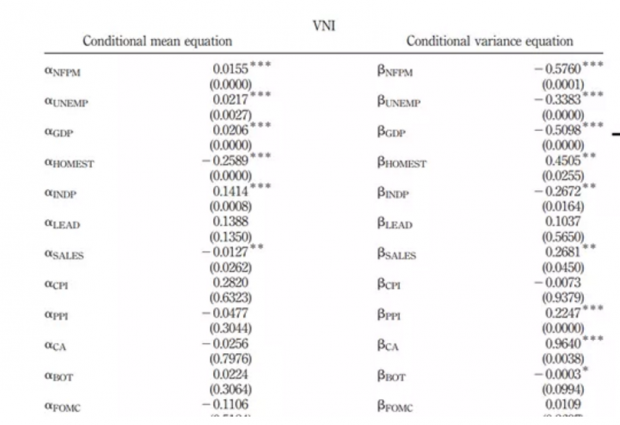

三、回归结果讨论

从回归结果可以看出,六个实体经济变量对条件均值的VNI收益率均有显著影响。从正向效应来看,美国经济的增长可能会刺激越南股市,加速美国和越南金融市场和实体经济市场的一体化。同样的,美国经济新闻数据变量对条件方差的VNI收益率也有显著的影响,美国经济新闻可以适当降低越南股票市场的波动性,毕竟美国与越南存在大量的贸易,美国的政治力量与经济力量在全球都发挥着不小的影响。作者还进行了稳健性检验,主要是加入S&P500作为控制变量,进行回归,回归结果基本稳健,在此不再赘述。

四、启发

综合来看,这篇文章的特色在于通过新颖的数据处理方法实证检验了美国宏观经济新闻对越南股市的溢出效应。特别是把通常我们认为很难匹配到一起的日、月、季度等数据通过合理的数据处理与计量模型设定,这很值得我们在日后研究中进行尝试。

Abstract

The purpose of this paper is to investigate the spillover effect of the US macroeconomic news on the first two moments of the Vietnamese stock market returns.The author collected market expectation and actual announcements data for 12 key US macroeconomic announcements for the period from August 2000 to September 2009 from Bloomberg. The dataset consists of monthly Non-farm payroll (NFPM),Unemployment level (UNEMP), Gross Domestic Product percentage level (GDP), Housing statistics

(HOMEST), Industrial production (INDP), Leading Indicator (LEAD), Retail Sales (SALES), Consumer Price Index (CPI), Producer Index (PPI), Current Account (CA, quarterly), Trade Balance (BOT), and the Federal Reserve’s target rates (FOMC, 8 times a year and ad hocmeetings if needed). TheMA-EGARCH (1,1) model is used for the empirical test of the US macroeconomic news spillover effects on the VNI general, the US real economic news has the strongest effect on the first two moments ofthe Vietnamese stock returns. This can be interpreted as evidence that Vietnamese market participants believe that the USA is targeting real economic activities other than other variables. It is also shown that even though the US stock market (proxied by S&P500 index) significantly affects the Vietnamese stock market returns, the spillover effect of the US macroeconomic news is still significant.The author does not explore further on the transmission channels of the spillover effects of the US news on the Vietnamese stock market, reserving this task for future research.The paper contributes to the extant literature in several ways. First, to the author’s knowledge, the current literature lacks empirical evidence for the impact of the US macroeconomic news on the first two moments of the Vietnamese stock markets. Given the growing integration between the two economies, evidenced by the fact that the USA is Vietnam’s largest foreign direct investor and importer, the US macroeconomic news is very important, not only for Vietnamese policy makers but also for market participants. Furthermore, the choice of a small and open market with increasing exposure to the world economy and vulnerable to the US news (i.e. Vietnam) would help in reducing the problem of endogeneity bias in previous studies employing large economy pairs, as the US news might affect the Vietnamese stock market but not the reverse.Finally, previous studies tend to investigate the impact of macro news only on conditional this study, both conditional returns and the conditional variance of returns are modelled simultaneously in a time-varying framework (MA-GARCH) to better capture the impact of macroeconomic news on stock returns and stock market volatility.

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号