阅读:0

听报道

推文人 | 王倩倩

来源:

原文信息:

Graf C, Quaglia F, Wolak F A. (Machine) learning from the COVID-19 lockdown about electricity market performance with a large share of renewables[J]. Journal of Environmental Economics and Management, 2020: 102398.

2020年初的一场COVID-19大流行,几乎导致全世界所有行业受到前所未有的挑战。特别是,各国政府迫于疫情影响全面停工停产,致使电力需求下滑明显,能源行业受到极大的负面冲击。Christoph等人于2021年发表在Journal of Environmental Economics and Management的文章(Machine) learning from the COVID-19 lockdown about electricity market performance with a large share of renewables以意大利春季疫情“封城”为背景,探究“封城”对于电力市场中可再生能源发电量增加对再调度成本的影响。

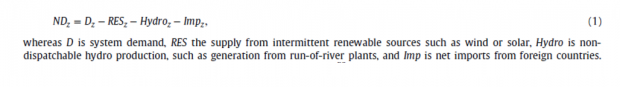

因疫情“封城”,显著减少对诸如火力发电厂等可控电力来源的需求。这些服务于净需求,即系统总需求与不可控电力来源(包括间歇性可再生能源,如风能,太阳能,水力发电和净进口)之间的差额。如下图方程式。因为在”封城”期间不可控电力的供应基本没有变化,那么受疫情负面影响的电力需求冲击转化为负面的净需求冲击。这样,“封城”措施及其相关的低净需求实现可以洞悉系统运营商在地区增加其供电行业中间歇性可再生能源份额时可能面临的挑战。从这个意义上讲,COVID-19“封城”为分析当前世界上许多国家根据气候政策目标设计间歇性可再生能源所占更高比例的电力市场的潜在弱点提供了独特的机会。

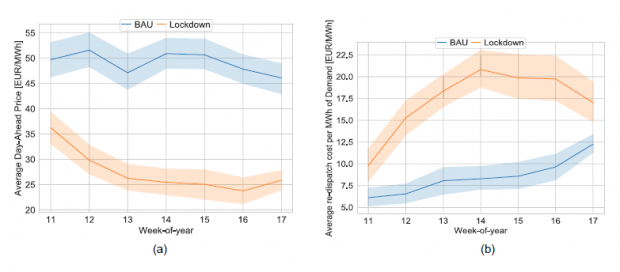

意大利的电力交易市场包括欧洲的日前交易市场、国内日间交易市场和实时再调度市场。粗略估计,意大利的“封城”导致常规业务(BAU)需求下降了20%,相当于在疫情发生前的需求水平下,风能和太阳能的产量增长了2.3倍。同时,与BAU相比,平均每小时日前市场电价下降了45%,如下图(a);但每兆瓦时需求的再调度成本却增加了71%,如下图(b)。

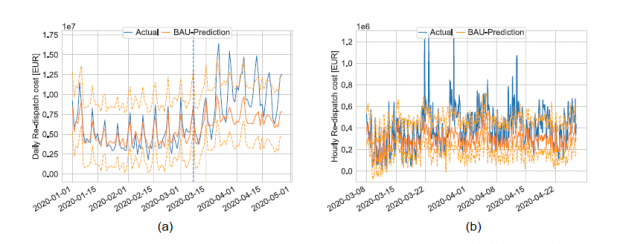

另外,作者根据2017年1月1日到2019年12月31日系统条件与重调度成本之间的小时关系的历史数据,使用深度学习神经网络模型,预测在“封城”期间BAU的再调度成本。结果发现,在”封城“期间的系统条件下,预计的BAU每小时再调度成本仅比BAU周期再调度成本高26%,预期值约为实际再调度成本增加73%的三分之一。这可能是因为在持续出现的低(净)需求时间内,投资组合中可控资源的供应商可能会采用新的报价策略来行使单边市场力量。

意义:再调度成本的增加并不能用这些成本将如何随着风能和太阳能发电份额增加的预测来衡量。它们只是表明,如果系统运营商不对传输和其他技术进行必要的投资来管理因间歇性可再生能源份额增加而导致的较低净需求水平,那么这些成本可能会增加多少。总得来说,动态的在线市场缓解系统对于缓解“封城“期间所看到的高额再调度成本可能会很有用。即使电力系统受到意外事件的影响,此类系统也具有适当缓解本地市场的能力。

Abstract

The negative demand shock due to the COVID-19 lockdown has reduced net demand for electricity—system demand less amount of energy produced by intermittent renewables, hydroelectric units, and net imports—that must be served by controllable generation units. Under normal demand conditions, introducing additional renewable generation capacity reduces net demand. Consequently, the lockdown can provide insights about electricity market performance with a large share of renewables. We find that although the lockdown reduced average day-ahead prices in Italy by 45%, re-dispatch costs increased by 73%, both relative to the average of the same magnitude for the same period in previous years. We estimate a deep-learning model using data from2017 to 2019 and find that predicted re-dispatch costs during the lockdown period are only 26% higher than the same period in previous years. We argue that the difference between actual and predicted lockdown period re-dispatch costs is the result of increased opportunities for suppliers with controllable units to exercise market power in the re-dispatch market in these persistently low net demand conditions. Our results imply that without grid investments and other technologies to manage low net demand conditions, an increased share of intermittent renewables is likely to increase the costs of maintaining a reliable grid.

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号