阅读:0

听报道

推文人 | 杜静玄

文章来源:

Zhao Chen,Zhikuo Liu,J.C.S Serrato,Daniel Yi Xu Nov,2019,working paper

引言

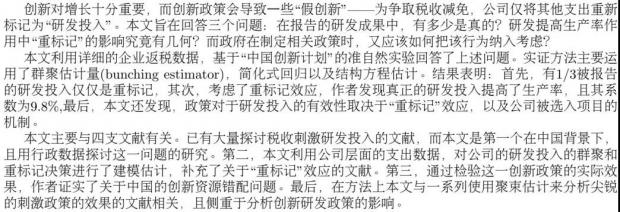

背景

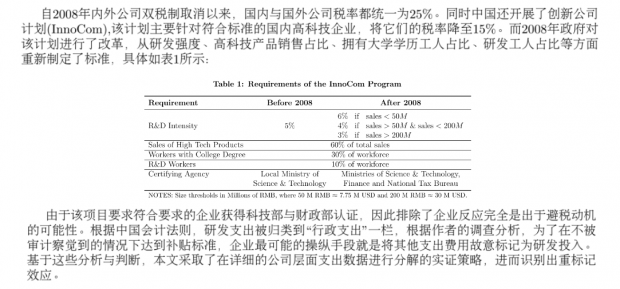

数据与描述统计

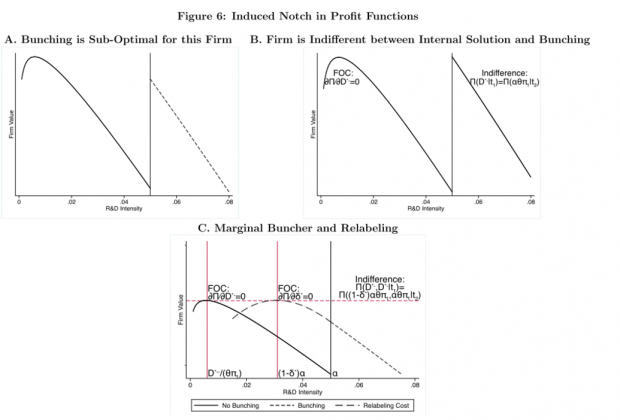

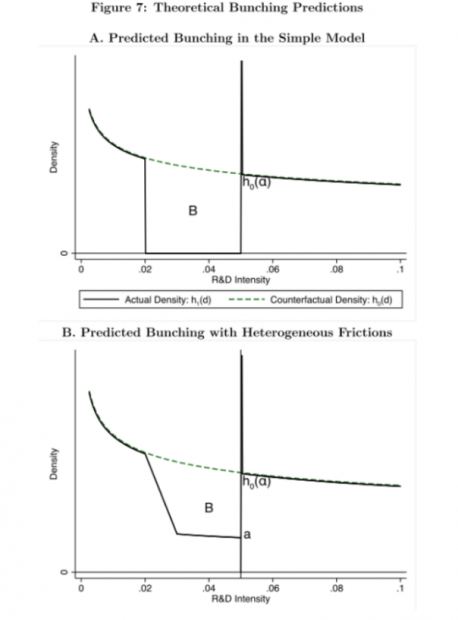

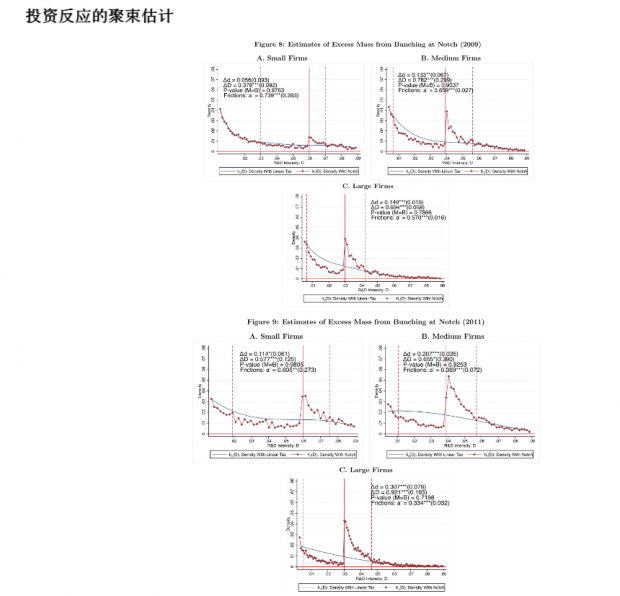

研发投入与税收优惠模型

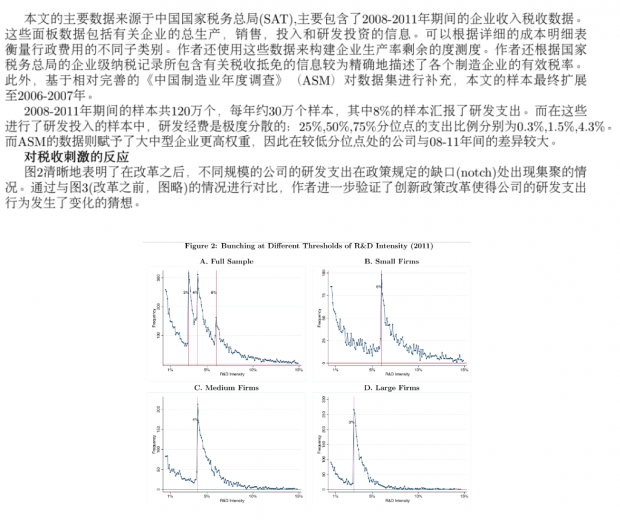

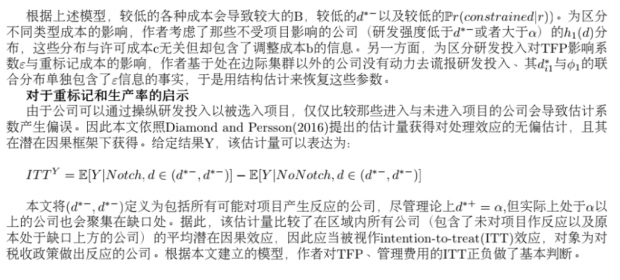

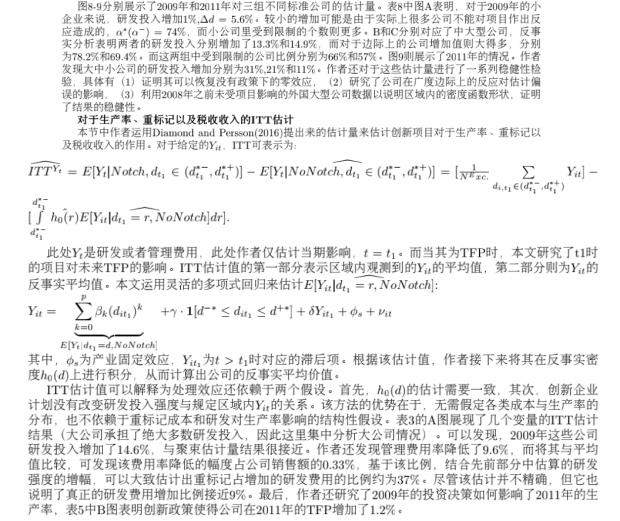

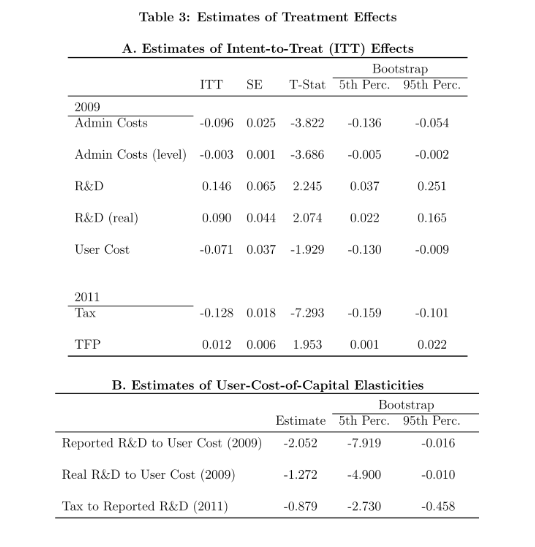

对投资、重标记和生产率的作用

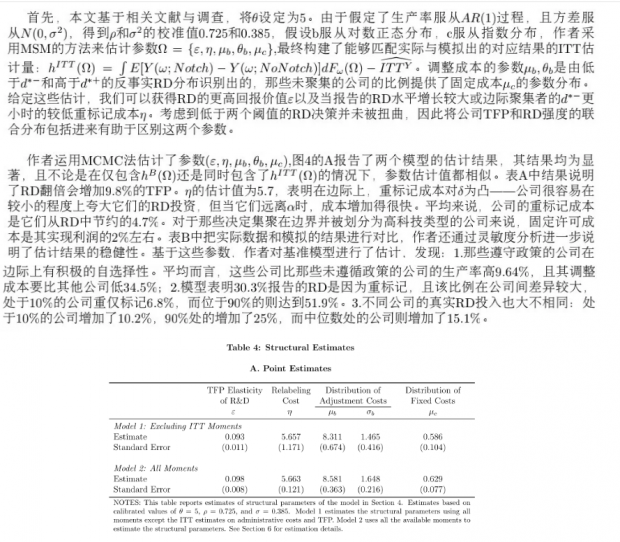

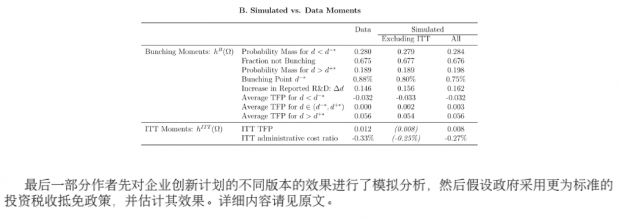

结构估计与反事实政策实验

结论

Abstract

We study a Chinese policy that awards substantial tax cuts to firms with R&D investment over a thresh-old, or notch. Quasi- experimental variation and administrative tax data show that firms significantlyincrease reported R&D, and that relabeling of expenses accounts for 30% of this increase. Accounting forrelabeling is crucial to obtain unbiased estimates of the productivity effects of real R&D and to quantifythe fiscal costs of stimulating R&D. We estimate a 9.8% productivity-to-R&D elasticity using a struc-tural model of investment and relabeling. Policy simulations show that selection into the program andrelabeling costs determine the cost-effectiveness of stimulating R&D.

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号